The St. Maarten Hospitality & Trade Association (SHTA) is very concerned about the timing and accuracy of recent statistics. Many decisions are likely to be based on this information and not having accurate and reliable figures for policy making can pose a major issue.

Two recent press releases have come to the SHTA’s attention. This week STAT released information concerning passenger movements at PJIA as well as a release a day later indicating that 2025 will be set as a new baseline for arrivals.

It’s great to see that our airport has seen a substantial increase in passenger movements. Any increase in ROI at the airport is welcome news after several years of reconstruction that somewhat limited capacity.

There is a projection for 1.8 million movements in 2025 with 256,923 arrivals in Q1. This brings the airport closer to, if not surpassing the record years pre-Irma.

The second press release is about arrival statistics and the past difficulty of separating resident from Visitors. PJIA’s system has not served as primary source of visitor arrival data, but that it provided a proxy during the translation period. It would appear that residents are considered 10% of total airport arrivals and that implies that the other 90% are visitors.

No actual data has been presented, but the earlier release sets Q1 arrivals at 256,923, this implies that roughly 26,000 arrivals were residents and 231,000 are visitors. That’s an average of 77,000 visitors per month for Q1 2025.

To find the highest visitor arrival number in recent years we have to go back to January 2016. The visitor arrivals for that month, according to STAT, was 59,000. This implies an increase of 30% over the previous record. That is substantial, but is it accurate?

Stayover visitor arrivals and cruise visitor arrivals are an important economic indicator. Together with the exit surveys that provide information on satisfaction and spending these should provide a clear picture of how the economy is doing. Tourism is our main source of income and foreign exchange. Much of the employment on Sint Maarten is directly or indirectly tourism dependent.

Sint Maarten is a hub for the surrounding islands. A considerable amount of the travelers arriving at PJIA go to the surrounding islands, via plane, ferry or charter, without spending a significant amount of time on Sint Maarten. There is also a large group of visitors that stay on the French Side. Money spent on the French side is money not spent in the Dutch side economy.

In 2024 PJIA saw roughly 1.665 million passenger movements. According to the new methodology, 10% are considered residents (not specified whether Dutch Side only or Dutch Side and French side) that is 167,000 passenger movements, equating to 83,000 resident return trips via PJIA. Average about 7,000 per month.

That leaves 1.5 million visitor movements. Roughly 750,000 visitors arriving and departing. With 1.8 million movements expected in 2025 that’s roughly 1.6 million visitor movements or 800,000 Visitors.

Early this year Winair issued a press release stating that it moved a record number of passengers to and from St Barths. 95,000 is mentioned. It is unclear whether that is 95,000 movements or 95,000 passengers equating to 190,000 movements.

If we assume that it is 95,000 movements. These are mainly tourists arriving at PJIA via air without spending any significant amount of time on Sint Maarten. So, these 95,000 Winair movements imply 95,000 additional movements for PJIA. That’s a total of 190,000 passenger movements at PJIA for 2024, due to St Barths alone. Anguilla receives a substantial number of visitors as well. Similarly, Saba and Statia, and to a lesser extent St Kitts and Nevis, depend on PJIA as a hub.

So, of the 1.5 million Visitor movements in 2024, almost 200,000 went to St Barths. Thats 13% of PJIA visitor movements servicing the St Barths market. Every St Barths visitor going via Winair equates to 4 passenger movements at PJIA, a visitor to Sint Maarten only triggers 2 movements.

Several times a year exit surveys are done at PJIA, these establish expenditure. It makes a big difference if that expenditure is multiplied by 750000 or 655000, and that’s just accounting for St Barths. The number will be substantially lower if all the other islands and the French side are accounted for. Remember a visitor staying in a villa or hotel on the French Side is spending that money in a different economy.

The visitor arrival number and their expenditure on the Dutch Side specifically is the primary economic indicator for Dutch Sint Maarten. We cannot afford to get this wrong, and adding visitors to the French Side and surrounding island severely inflates that number creating an impression of economic activity that just isn’t present. Overstating the wealth of our economy based on partially correct information is not a sound approach for a decision making process.

On a quarterly basis the Central Bank reports on tourism expenditure. We have never seen the calculations although we have asked but understand that it is visitors multiplied by the expected expenditure. The numbers reported by STAT in their tourism exit survey reports are substantially lower than those reported by the CBCS. All are supposedly dependent on the arrival figures.

There are a few other statistical indicators

Independent indicator 1; foreign credit card expenditure

The CBCS also reports on credit card usage on their yellow book reports (last year available 2022) they apply the same methodology for Curacao. An important indicator is the Transaction value of foreign issued credit cards in country. When we convert cruise and visitor arrivals into Visitor days we can compare. What we see is that in Sint Maarten credit card expenditure per visitor day is a much lower than in curacao. This can be expected since visitors also spend on the French Side of Sint Maarten. The CBCS indicates that usage of credit cards per dollar spent on Sint Maarten is much lower than in Curacao. Obviously, this makes no sense, there is likely an issue with total spend because of the visitor or the expenditure number.

In Curacao over the period 2015-2022, 78% of tourism expenditure was done via credit card. In St. Maarten, that figure is 46%. If we consider the 78% from Curacao, we get a substantially lower tourism expenditure on the Dutch side; we average Cg.494 million annual in tourism expenditure less on an average of 1.239 Million in annual expenditure.

Expenditure is polled via a sampling, so the issue is likely in the visitor number. To compensate for the lower expenditure, we need to reduce the stayover visitor total by 40%.

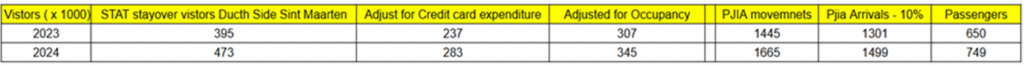

That means that in 2023 the STAT reported 395,000 Stayover visitors is 237,000 visitors and the 473,000 visitors in 2024 is 284,000 Visitors staying on the Dutch side of Sint Maarten.

Independent Indicator 2; Hotel and vacation rental occupancy.

This year the SHTA also received insight into the Independent Vacation Rental market. Combined with SHTA’s occupancy statistics and the Tourism Exit survey info on average travel group size and length of stay, allows us to estimate the actual number of visitors staying on the Dutch (and French side)

According to our analysis in 2024, 345,000 visitors stayed in Dutch Side accommodation ( Hotels/Resorts and IVR combined) from a total of 1.66 million passenger movements at PJIA means that 21% of the passenger movement total is a visitor staying on the Dutch side of SXM.

For 2023, 307,000 visitors stayed in Dutch side accommodations, hotels and resorts from a total of 24% of the 1.254 million passenger movements at PJIA.

What this means is that from the 406,000 additional passenger movements at PJIA, only 10% found their way to Dutch side accommodations. Substantially lower than the overall average. It appears that the bulk of the growth in passenger movements at PJIA is a result of their hub function. Great for PJIA and the region, but not so much for the Dutch Sint Maarten economy.

We realize this is quite the word and number salad. So here are the findings in a table.

While both adjustment methods show substantially lower number of stayover visitors than STAT reports. The visitors adjusted for the Credit card usage is even lower than when adjusted for occupancy.

Without additional data there isn’t any way of testing. Likely the occupancy number is closer to accuracy, however visitors staying on the Dutch Side also spend on the French Side. Of course, visitors staying on the French Side spend on the Dutch Side as well. But the bulk of tourist expenditure is for accommodations and food service. With the French side having the bulk of the high-end villas and restaurants, it would seem that spending from French side visitors on the Dutch side does not compensate for Dutch Side visitors on the French side.

Clearly, we have an issue with our statistics but overestimating them does not create more income. On the contrary, overestimating them creates an overestimation in economic activity. This leads to the perception that tax compliance is low and creates risk for investors. The result is misinformed policy. In the end consistently overestimating statistics is not sustainable.

Sint Maarten is a complicated economy with complicated statistics. There is significantly more data that can be analyzed for information, but this needs to be done through stakeholder consultation and investing in data systems. Transparency and data sharing are key. With the right data, correct policy that benefits the economy can be developed, including tax and healthcare reform as well as how we manage our tourism product.